Last month we joined our partners Spaulding Ridge for their Revenue Elevate event, where RevOps professionals came together virtually to uncover ways to rethink revenue. Revenue leaders are going through the gauntlet. The increasing pressure to deliver with tighter constraints weighs on every sales leader across all verticals. What can a CRO do? We held a breakout session discussing the importance of managing revenue effectively while exploring two sides of the revenue coin: revenue operations (RevOps) and revenue recognition, also known as RevRec. In this blog, we’ll recap the session and dive into the interconnectedness of sales revenue and revenue accounting.

Managing Revenue Effectively

Let’s start by understanding that in today’s fast-paced business world, companies need to manage their revenue effectively to stay ahead- to prevent revenue leakage on the front end, and to implement processes and technologies on the backend that allow you the flexibility needed to keep up with modern business models. Revenue operations and revenue recognition are two important aspects of managing revenue effectively. We’ll explore these two sides of the revenue coin and how they can be streamlined through automation and unified data so your organization runs like a well-oiled revenue machine.

Revenue Operations and Revenue Recognition are Interconnected

Revenue operations and revenue recognition are distinct concepts but heavily intertwined. Revenue Operations involves managing the front-office activities that generate revenue, such as sales, marketing, and customer service. However, on the other side, revenue recognition involves managing the back-office activities that account for revenue, such as accounting and finance.

Without alignment between RevOps and Rev Rec, a company can experience significant financial and operational risks. We see this when news of a public company is released for having a “material weakness due to accounting” or failing an audit. If a company’s RevOps team is focused solely on maximizing revenue growth without considering the impact on revenue recognition, it could lead to overstating revenue or recognizing revenue prematurely, which could result in financial misstatements and regulatory compliance issues. On the other hand, if revenue recognition policies are too conservative, they could limit the growth potential of the business and put pressure on the RevOps team to achieve unrealistic revenue targets.

Therefore, it is essential to align the motions of RevOps and revenue recognition to ensure that revenue is generated, recognized, and reported accurately and efficiently. This can be achieved through collaboration and communication between the two teams, as well as the use of technology and data analytics to support decision-making and ensure compliance with accounting standards and regulations, like ASC 606. By aligning RevOps and revenue recognition, a company can improve its financial performance, mitigate risks, and achieve sustainable growth over the long term.

Aligning Front-Office and Back-Office Operations

So let’s begin to understand the impact that upstream revenue operations can have on downstream revenue management and, vice versa, the impact that back-office system limitations can have on stalling revenue growth is crucial for ensuring Lead-to-Revenue efficiency.

Accounting principles are complex, but revenue recognition within B2B SaaS can get especially tricky. While RevOps and SalesOps teams aren’t expected to be accounting experts, understanding how Revenue Recognition affects their revenue teams is a crucial part of developing ways to optimize operations related to the process. The most successful teams have a holistic approach to managing revenue operations and revenue recognition.

Automating the Lead-to-Revenue process helps to streamline the entire process from when a customer places an order to when revenue is entered into the General Ledger as a journal entry. Automation can also help to ensure that revenue recognition is done in a timely and accurate manner, making front-office and back-office teams more efficient.

You’re probably familiar with RevOps solutions that allow sales users to Configure, Price, and Quote, but you might not know that revenue accountants rely heavily on the accuracy of the data from the quoting process. The data in your sales agreements is the source of truth for what was agreed upon between you and your customer. Therefore, that data must be correctly mapped to all your systems, such as CRM and Billing.

The back office accountants use data from the Order like Contract Number, Customer Name, Contract Term, Deliverables, Skus, Qty, Sell Price (discounts), billing terms, etc., to generate Revenue Contracts and assign revenue recognition rules to comply with accounting guidelines, such as ASC 606 or IFRS15. Without automation, these critical details are entered manually in a multitude of spreadsheets which are susceptible to errors. But by unifying the revenue data (from Prospect to Cash) in a single system, RevOps and revenue accounting teams can ensure alignment and accuracy by referencing the same dataset.

When data is unified, it can be easily shared across different departments, which helps to ensure that everyone has access to the same data. This can help to reduce errors, improve collaboration, and increase efficiency. For example, by having a unified view of the customer, sales and finance teams can work together to ensure that revenue is recognized accurately and on time. Quality data depends on human action and reliable technology. The dependency on the accuracy of upstream data is imperative to optimize the Lead-to-Revenue process. Incorrect Quote data flows downstream to billings, revenue, fulfillment, and cash application, resulting in underwhelming customer satisfaction (internal and external).

Lead-to-Revenue for Recurring Revenue Models

With the recent adoption of recurring revenue models like subscription and consumption or usage, it’s never been more important to align the front-office Revenue Operations with the back-office revenue accounting processes. Converting leads into cash flow in a recurring revenue model requires a much tighter set of informed and coordinated set of motions all along the revenue cycle – including demand generation, opportunity development, value selling, as well as customer retention and expansion. This forces organizations to rethink and reengineer how they manage their lead-to-cash cycle.

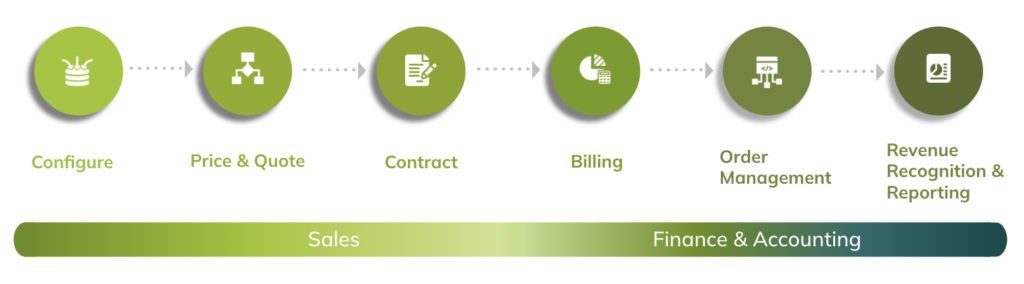

Let’s quickly review the lead-to-revenue process:

- Configure: The set of products and services included in an agreement.

- Price and Quote: The way these deliverables are priced and quoted to a business prospect.

- Contract: The official agreement presented to the prospect.

- Billing: The itemized billing created and sent by the Accounting team for money owed based on the signed contract.

- Contract Lifecycle and Order Management: The management of a contract from initiation through execution, performance, and renewal/expiry.

- Revenue Recognition: Reporting on revenue once products and services promised have been delivered.

At each stage, data and information from the previous stage are crucial to ensuring accurate revenue reporting and compliance with accounting standards. Therefore, the last stages shouldn’t be an afterthought, as those numbers are presented to board members, investors, and shareholders.

And that’s why RightRev exists! RightRev removes the guesswork and manual inputs by automating revenue recognition based on data from your CPQ and Billing solution.

Automating Revenue Recognition for Complete Revenue Visibility

RightRev is a complete revenue sub-ledger, built to comply with ASC 606 and IFRS15 by driving revenue recognition workflows directly from approved Orders and Billings for Salesforce Revenue Cloud customers or any Billing platform you use through APIs.

RightRev automates revenue recognition with out-of-the-box features that map directly to sales-approved orders for accuracy. Revenue forecasting capabilities give users visibility into planned and recognized revenue metrics. Standalone Selling Price (SSP) calculations are built-in and easy to configure. GAAP and operational reports are easy to use and can be configured based on requirements. One of the most significant values added for reporting in RightRev is combining sales, billings, and revenue data in a single platform.

Revenue operations and revenue recognition are two sides of the revenue coin that need to be managed effectively to ensure business success. By automating the Lead-to-Revenue process and having unified data, companies can streamline their revenue operations and revenue recognition processes so they run like a well-oiled machine. With increasing pressure to drive revenue, changing pricing models, and business needs, it’s never been more important to ensure alignment on both sides of the revenue coin.

Watch the session recording.

Interested in learning more about RightRev? Request a meeting.

And finally, you can follow us on LinkedIn for more revenue recognition insights.