It’s inescapable. Regardless of its industry, every company that relies on customer contracts must clearly understand how and when to recognize revenue or risk negative ramifications that include misguiding investors and other stakeholders.

This process is critical as it determines the financial health of the company and ensures compliance with accounting standards and regulations. But for software as a service (SaaS) companies, this task can appear nearly insurmountable at times—laborious, tedious, and complicated for various reasons.

The introduction of ASC 606 by the Financial Accounting Standards Board (FASB) in 2014 helped standardize revenue recognition across the board. But many questions still understandably surround SaaS revenue recognition and all its industry-specific intricacies. Don’t worry, if this makes your head spin, we’ll break it down for you.

This article explores the fundamentals of SaaS revenue recognition and provides guidance on maintaining compliance. Let’s go ahead and get started.

What Is SaaS Revenue Recognition?

Revenue recognition refers to recording and reporting revenue so that a company’s financial performance is accurately reflected. For a SaaS company, this comes down to recognizing revenue at the right time. In other words, cash that immediately comes in after a booking isn’t considered revenue until the goods or service(s) have been delivered to the customer.

SaaS companies must recognize and report their revenue in compliance with established financial accounting standards ASC 606 and IFRS 15, which were established by the FASB and International Accounting Standards Board (IASB). The standards were developed to make financial reporting across all industries more consistent so investors and others can understand and compare them more easily and make better decisions.

If a company doesn’t recognize its revenue properly, its financial health may be misrepresented, leading to potential legal consequences. This is perhaps best demonstrated by the 2001 Enron scandal, when improper revenue recognition practices led to one of the largest corporate bankruptcies in history.

So, what must SaaS companies do to achieve compliance? Below, we briefly summarize some of these requirements:

- Document and justify revenue recognition methods

- Create and periodically update revenue recognition policies

- Disclose revenue-related information in financial statements

- Assess and potentially modify contracts and revenue streams

- Adjust necessary financial reporting procedures

Several regulatory entities, such as the Securities and Exchange Commission (SEC), monitor companies to ensure they comply with ASC 606. They conduct audits and impose penalties, including fines, when a business is found to be non-compliant. For public companies, non-compliance with ASC 606 could lead to Nasdaq delisting.

A company’s credibility and reputation can also suffer if it doesn’t abide by ASC 606 principles. Additionally, lawsuits by shareholders and customers are a real threat when a business’s financial statements are found to be misleading and/or incorrect.

Ultimately, SaaS revenue recognition isn’t just a financial accounting requirement. It’s also a way for companies to build and maintain trust with investors, clients, and peers.

Key Concepts in SaaS Revenue Recognition

Now that we’ve defined revenue recognition, let’s discuss several of its core components, all of which play a part in how SaaS companies report revenue under ASC 606.

Deferred Revenue and Contract Liability

Deferred revenue (also referred to as unearned revenue) is money already billed but can’t yet be recognized as revenue because the product or service hasn’t been rendered. It’s considered a liability because the customer could still potentially ask for a refund.

A contract liability, meanwhile, is an obligation by the company to transfer goods or services to its customer when it has already received the amount due.

Deferred revenue and contract liability safeguard against potential financial misrepresentation, offering transparency and accuracy in SaaS companies’ financial statements, fostering investor and regulatory confidence, and supporting long-term business sustainability.

Unbilled and Contract Asset Revenue Recognition Principle

Then there’s unbilled revenue. This money is recognized but unable to be billed to the customer because of contractual billing milestones or schedules. It is considered an asset until the customer is billed.

Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR)

Annual Recurring Revenue (ARR) is a metric that shows SaaS companies how much recurring revenue they can expect from annual subscriptions. Monthly Recurring Revenue (MRR) is simply ARR broken down into a monthly amount.

There are various types of MRR: new, expansion, and contraction. MRR that came from subscriptions created during that period is considered a new MRR.

If the revenue comes from existing subscribers, on the other hand, it’s called expansion MRR. If it is lost revenue due to downgrades, cancellations, non-renewals, discounts, or the removal of add-ons, it’s known as contraction MRR.

Bookings

As SaaS companies implement ASC 606 revenue recognition principles, they must keep tabs on their bookings (a commitment from a customer to pay for a good or service). There are different types of bookings, including new, renewal, and upgrades.

Annual Contract Value (ACV) bookings represent the total projected revenue from signed contracts with customers over a one-year period. Total Contract Value (TCV) bookings, meanwhile, refer to the total value of all contracts or agreements signed with customers over a specific period, typically representing the potential revenue generated from those contracts throughout their duration. Finally, non-recurring bookings comprise one-off fees (e.g., training, set-up).

This metric is forward-looking. It anticipates future revenue growth and can also help finance teams plan cash outflows and inflows.

Billings

The amounts charged to clients are referred to as billings. Billings are presented in the form of an invoice. Lots of bookings but low billings can indicate cash flow issues. It can benefit SaaS companies to encourage customers to pay upfront (thereby increasing their billings).

Revenue

After a SaaS company has provided a service to its customers, its income is called revenue. According to Generally Accepted Accounting Principles (GAAP), as the service is delivered successfully every month, the business can recognize revenue for that time.

That’s because now it has earned the revenue. This is the basic premise behind accrual accounting (in other words, record revenue once it’s been earned, not when the cash comes in).

Subscription-based SaaS companies are more apt to use accrual accounting rather than cash-basis accounting which helps track the MRR (see above).

Also, note that it’s generally best for finance teams to assess revenue based on recognized revenue instead of bookings and billings, which might inflate the revenue numbers.

Performance Obligations

A performance obligation represents a commitment by a company to provide a specific product, service, or bundle of products and services to a customer. These commitments are considered distinct, separate obligations within a contract and are used to determine how revenue should be recognized over time.

5-Step Revenue Recognition Model for SaaS Businesses

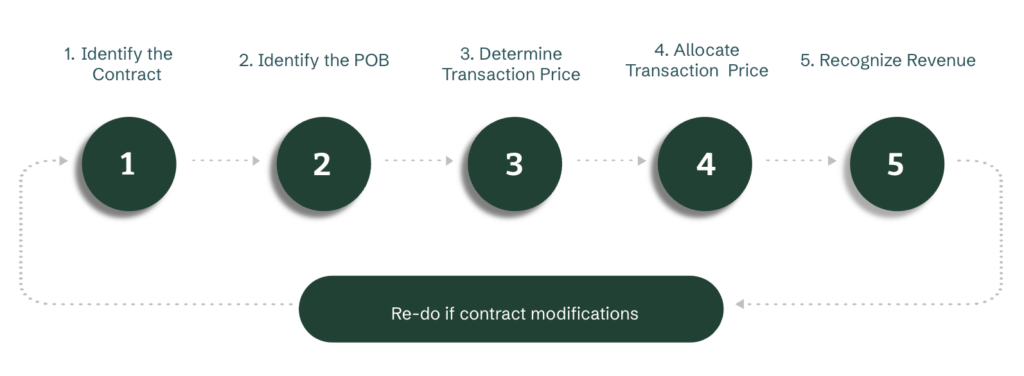

ASC 606 provides SaaS companies with a five-step framework that dictates how and when they should recognize revenue. Below, we briefly explore each step.

Identify the Contract With a Customer

When providing goods and services to a customer, a SaaS company must establish a contract that clearly outlines each party’s obligations, and both entities must agree to it. A contract with a customer typically includes details like the contract term, the deliverables, the billing frequency, and pricing. Having a single system to capture all relevant details and contract modifications via a service like RightRev can be immensely helpful.

Identify the Performance Obligations in the Contract

Next, each distinct product or service (performance obligation) must be identified and described within the contract. Performance obligations must be satisfied (transferred from the company to the customer) to be recognized as revenue.

For SaaS companies, performance obligations often include subscriptions, hardware, training, implementation, and other professional services. Unless a company partners with a revenue recognition automation firm like RightRev, its finance team generally gets stuck with the difficult task of manually tracking any related deals and discounts for each performance obligation. RightRev automatically identifies performance obligations within revenue contracts & assigns proper revenue rules that apply the appropriate revenue treatment for each separate performance obligation in a single revenue contract.

Determine the Transaction Price

At this point in the revenue recognition process, a transaction price (monetary value) needs to be identified for each performance obligation. This can get complicated quickly because variable considerations like discounts, rebates, and refunds must be considered. SaaS finance teams must determine the standalone selling prices of different products and services and record the method used to determine each transaction price.

Allocate the Transaction Price

Now the transaction prices must be allocated across the performance obligations listed in the contract. You cannot simply divide the total contract value by the number of performance obligations and allocate it evenly across the products and services. Because SaaS companies usually deliver their products and services via a recurring subscription rather than in a single instance, the overall arrangement fee must be recognized over the entire subscription period. Transactions often include additional performance obligations like training, equipment, and integration services that should be valued separately.

This part of the process is often very complex, time-consuming, and prone to error when performed manually. Revenue recognition companies like RightRev save finance teams a tremendous amount of time and effort by automating this and using predefined rules—eliminating a ton of spreadsheets!

Recognize Revenue When (or as) the Performance Obligation Is Satisfied

Finally, the revenue can be recognized either at a single point or over time as the customer receives the goods or services. Various teams within the company must generally work together to determine exactly when, how, and to what extent each performance obligation has been satisfied—another challenging aspect of the process that is vastly simplified and improved via automation.

Key Challenges of SaaS Revenue Recognition

SaaS companies typically face unique revenue recognition-related challenges they must tackle and overcome. We’ll dive into some of the most common pitfalls below and discuss how to stay in compliance.

Multi-Element Arrangements (Bundles)

Revenue recognition can get tricky when a SaaS business provides multi-element arrangements (bundled features). These often include support services, customization, and set-up or consulting fees. These features can be optional or obligatory to make things even more confusing.

The company’s finance team must determine which services have standalone value. For example, let’s say that Company ABC charges $12,000 annually for its software service, but each customer must also pay a set-up fee of $1,500.

If the set-up fee is obligatory and combined with the annual subscription fees, the business will be required to recognize the set-up fee over the lifetime of the entire plan along with the software, being that the set-up fee is not distinct and therefore does not have its own performance obligation. If the fee, on the other hand, is optional and considered its own distinct service, the revenue from the set-up fee will need to be recognized separately.

Complex Contractual Terms

Another challenge in SaaS revenue recognition involves complex contractual terms. Unlike traditional software sales, SaaS agreements often feature intricate pricing structures, subscription tiers, add-ons, and renewal conditions. These complexities can make it hard for companies to accurately determine when and how to recognize revenue from these contracts.

To stay compliant with accounting standards like ASC 606 or IFRS 15, SaaS companies must carry out careful analysis and utilize robust systems to track and interpret the nuances of each customer agreement. Failure to effectively manage these details can quickly lead to revenue recognition errors, financial misstatements, and compliance issues. SaaS companies must invest in advanced revenue recognition solutions and expertise to address this challenge.

Multiple Legal Entities

Then, the challenge arises when SaaS companies expand globally, create subsidiaries, or establish separate legal entities to operate in different regions. Each entity may have its own revenue streams, customer contracts, and accounting practices.

Ensuring consistent and compliant revenue recognition across all these diverse entities isn’t always easy. Finance teams must have a deep understanding of local accounting regulations and tax laws and an ability to accurately consolidate financial data. If SaaS companies don’t get this right, they may encounter discrepancies in revenue reporting, compliance issues, and potential financial and reputational risks.

Contract Modifications

SaaS businesses often offer flexible subscription models, meaning their customers frequently request agreement changes. These modifications can include adding or removing products, adjusting contract terms, and expanding user licenses.

Keeping track of all these changes can be an absolute nightmare—finance teams must determine exactly how each modification will affect the timing and amount of the revenue recognition. And one little mistake anywhere can have a cascading effect throughout the entire process.

How to Calculate Revenue Recognition (Types of Methods)

As we’ve established by now, the revenue recognition process is a critical aspect of accrual accounting—where revenue is recognized when it’s earned rather than when cash is received. In the context of SaaS, there are several methods companies can use to calculate when, how, and to what extent revenue is recognized.

Let’s take a look at them.

Accrual Method

The accrual method recognizes income when it’s earned, typically as the service is provided, regardless of when payment is received, ensuring a more accurate reflection of a company’s financial performance over time. When a customer pays the company before it provides the service, this is called deferred revenue and is considered a liability.

Sales-Basis Method

The sales-basis method recognizes revenue immediately when the SaaS product or service is sold or when the contractual obligations are met, whichever occurs earlier. It aligns revenue recognition with actual sales transactions.

Appreciation Method

The appreciation method allocates revenue over the customer’s subscription term based on the estimated fair value of the service at each reporting period, recognizing a higher portion of revenue upfront and gradually recognizing the remaining balance over time as the service gains value.

Percentage-of-Completion Method

The percentage-of-completion method recognizes revenue as a percentage of the total contract value based on the extent of service delivery or completion of separate performance obligations over time.

To use this method, SaaS companies must have a long-term contract in place that is legally enforceable and be able to estimate the percentage of the project that is completed (plus future costs and revenues).

Proportional Performance

Proportional performance recognizes revenue over time as the service (performance obligation) is delivered, with revenue recognized in proportion to the level of service provided to the customer throughout the subscription period.

Completed Contract Method

The completed contract method recognizes all revenue once the SaaS project is fully completed rather than recognizing it incrementally throughout its scope. This is usually used for short-term projects.

Ultimately, a SaaS company’s decision to use a specific method of recognizing revenue should align with the substance of its contracts and the guidance provided by ASC 606. Businesses should also consider the impact of their choice on their financial statements, business models, and customer agreements. Consulting with accounting experts and staying up-to-date with evolving accounting standards is crucial for accurate revenue recognition.

SaaS Revenue Recognition Examples

Subscription businesses often find themselves in the position of recognizing monthly or annual subscription fees over a specific subscription period. To improve their revenue recognition processes, these companies should develop comprehensive, clear, and well-documented policies so employees across different departments understand the exact guidelines for recognizing revenue. This will help reduce the risk of misstatements or non-compliance.

Another actionable strategy for SaaS companies is implementing automated revenue recognition systems like RightRev. These systems can help dramatically streamline the process by automatically applying revenue recognition rules to contracts and calculating revenue accordingly.

Additionally, regular internal audits can help companies identify discrepancies or errors. By emphasizing the importance of documentation and automation, SaaS companies can enhance the accuracy and transparency of their revenue recognition processes, building trust with stakeholders and investors.

SaaS Revenue Recognition Has Its Own Unique Set of Challenges

No company can disregard the FASB’s ASC 606 revenue recognition framework and guidelines without facing serious financial, reputational, and legal risks. The same goes for businesses in the SaaS industry, but on top of all that, they have their own specific set of challenges to overcome when they recognize revenue.

From the prevalence of subscription-based business models to ever-changing contract terms to how they deliver their goods and services, SaaS companies have a lot to stay on top of and simply can’t afford to get lax about this aspect of their business. No matter how tedious the job is, their finance professionals must achieve continual compliance with all the established revenue recognition standards.

How RightRev’s Revenue Recognition Can Help Your Business

Staying ahead of the SaaS revenue recognition game isn’t easy—it requires tons of hours spent poring over spreadsheets and a tremendous amount of specialized knowledge. This is where RightRev steps in.

Built by the pioneers of revenue recognition automation, the company can automate up to 100% of your revenue recognition process. (Doesn’t that sound amazing?) Flexible, scalable, and easily integrated into your existing infrastructure, RightRev’s technology and tools handle high-volume transaction throughput with precision and agility, streamlining compliance efforts and significantly reducing the risk of errors—no matter your business model.

So, what are you waiting for? It’s time to liberate yourself and your team from all those spreadsheets and get back to working on the strategic initiatives that energize you and grow your company.

Get in touch with RightRev today! We’d love to hear any questions you have about SaaS revenue recognition.