The rise of AI agents in finance has sparked both excitement and uncertainty among accounting professionals, but what’s actually ready for implementation, and what’s still just hype? In this essential webinar, RightRev CFO Dan Miller and Numeric’s Ben Sheridan cut through the noise to deliver a pragmatic, expert-led discussion on agentic finance. Drawing on recent research from Stanford, MIT, and IBM, they explore the current state of AI adoption in accounting, clarify what truly defines an AI agent versus superficial automation, and outline the critical distinction between deterministic, rules-based processes and probabilistic AI outputs. Whether you’re evaluating new AI-powered tools, concerned about auditability and compliance, or simply trying to future-proof your finance function, this conversation offers actionable frameworks for making smart technology decisions in an era of rapid change.

Below, we’ve captured the full conversation between Dan and Ben packed with practical insights, real-world examples, and honest assessments of where AI can help your finance team today (and where it’s not quite ready yet).

Demystifying AI Agents in Finance: Expert Insights from RightRev and Numeric

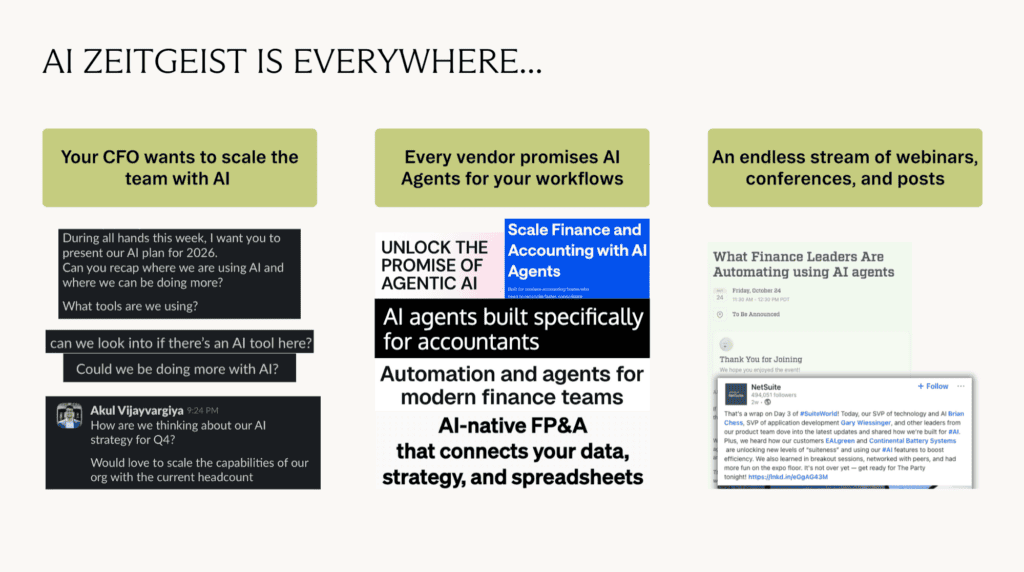

The accounting world is buzzing with AI terminology: agents, AI-enabled, AI-powered; creating an alphabet soup of confusion. But what do these terms actually mean for finance teams? And more importantly, how should CFOs and controllers evaluate this new wave of technology?

In a recent webinar, Dan Miller, CFO of RightRev, and Ben Sheridan, Accounting Subject Matter Expert at Numeric, cut through the noise to provide practical guidance on AI agents in accounting. Both bring unique perspectives: Dan as a CPA who spent 30 years in finance before joining RightRev (and previously serving as CFO at Fastly), and Ben as a former KPMG auditor and Snowflake revenue accounting manager who now shapes product strategy at Numeric.

The FOMO Factor: Are You Really Behind?

“I think this is the FOMO thing that accountants are worried about,” Dan observed. “What are we missing? My skill set is getting stale. I’m not going to be employable.”

But here’s the reality check: A recent study from Stanford, Berkeley, and IBM surveying 306 accountants and back-office professionals found that AI prevalence remains very low, and use cases are still quite simple.

“At the moment, the FOMO thing is probably more hype than actual reality,” Dan noted.

Why AI Deployments Are Struggling

An MIT report on AI deployments revealed some stark figures about why organizations aren’t seeing expected returns. Ben highlighted a critical finding: “One thing that did get called out was essentially the attempt to use AI was misordered, meaning people were trying to automate intelligence before automating their basic operations.”

The dependency on data quality, consistency, and proper guardrails cannot be overstated. “If you’re doing an AI project, you should make sure that your process works without the AI, maybe not as well as it someday will with the AI,” the moderator summarized. “At least you have a backup plan if you don’t get the ROI.”

What Actually Is an AI Agent?

Numeric’s Definition: Governed, Auditable, Contextual

Ben outlined Numeric’s perspective: “We really care that we can own the outcome, that we have the proper guardrails, structure and context, and also give folks the tools to audit these outputs before deploying them.”

He differentiated between simply prompting an LLM and creating a truly agentic workflow: “If I have an LLM and I give it access to my Google calendar and I say ‘when is my next meeting with this person,’ it might give me an answer. It is doing some work with me but constrained by the tools I give it. In that same context, if I give it a broad array of tools and the license to reason and action through that array of tools on its own to answer more sophisticated questions, you’re getting to a higher degree of agency.”

The key principle: Control over data sources, operational context, and where human review gets layered into the process.

The Specificity Principle

Dan emphasized a crucial insight from customer conversations: “The more specific the agent, that’s what we’re seeing work today. You sort of have these things trying to do too much. It’s tough. So the baby steps resonated with me.”

RightRev is particularly interested in context-aware agents rather than fully autonomous ones. “We’re ways away from the autonomous stuff for a whole bunch of reasons,” Dan explained, “but the context-aware is super interesting.”

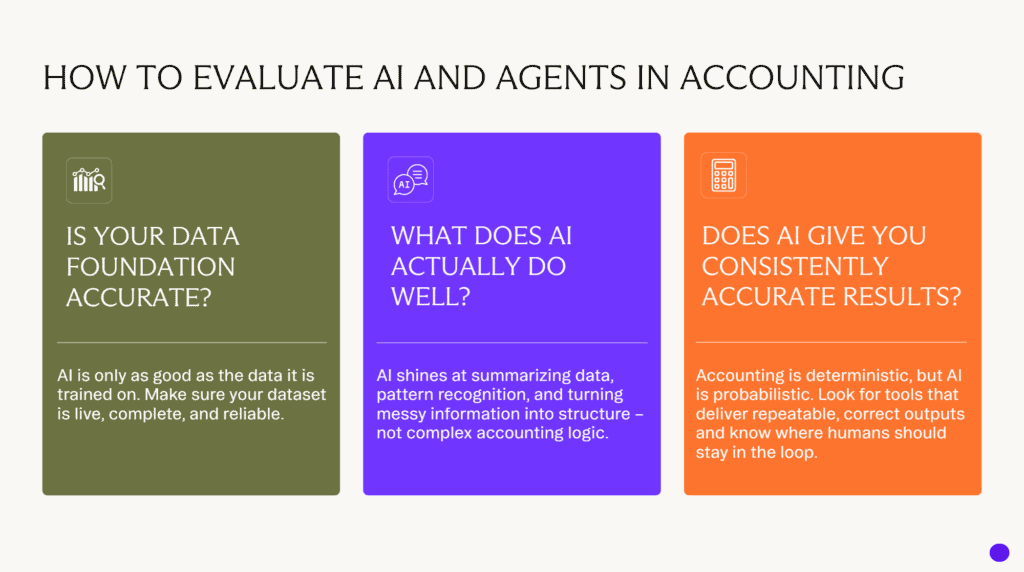

Deterministic vs. Probabilistic: A Critical Distinction

Understanding the Difference

Ben provided a clear explanation of this fundamental concept: “Deterministic is like legacy software when you know what the code is written, you know the logic as structured, and you can validate the execution of it, you have a known, repeatable, consistent output of that program.”

In contrast, AI and LLMs are probabilistic: “You don’t have always the same insight into how this is going to run the second, third, fourth, fifth time. It’s not necessarily going to always give me the same answer every single time. But it can take context, data, and tools and it can infer and give me useful insights.”

Where Each Approach Works

Probabilistic AI excels at:

- Variance analysis and flux explanations

- Data summarization and pattern recognition

- Suggesting rules based on historical patterns

- Anomaly detection across large datasets

Deterministic systems are essential for:

- Revenue recognition calculations

- Compliance-critical accounting

- Audit trail requirements

- Repeatable, verifiable processes

Dan was emphatic about revenue recognition: “We don’t find people wanting to handwave at getting it sort of right. And obviously the auditors aren’t anywhere near that. So rules-based deterministic is where we’re still at.”

The Hybrid Approach

Both companies employ sophisticated hybrid models. For Numeric’s cash matching, “AI is probabilistic in suggesting rules which might be successful in the engine, but ultimately when we run these rules and do the cash matching, it’s deterministic software which is creating the accounting and which is known to execute correctly in the same way every time,” Ben explained.

RightRev uses a similar approach for new SKU setup: “If you have a new SKU at scale, our agentic approach is to say, ‘Okay, great. Look at the other similar SKUs, do the analysis, and make a recommendation around what that rule should be.’ So it’s a really nice use of both of those for where they’re good and where they’re appropriate.”

Real-World Applications: How AI Agents Work Today

Numeric’s AI-Powered Toolkit

Ben detailed several practical implementations:

Monitors for Anomaly Detection:

Numeric’s monitor product allows users to set conditions (e.g., “transaction amount is above X and account is software expense”) to flag high-risk transactions. The AI enhancement? “You can use natural language to request a certain type of monitor and the AI will draft and spin it up for you. And what’s nice is you can actually look at these fields and conditions and validate that yes, this makes sense.”

Some companies are reaching match rates exceeding 90% automatically using AI-suggested rules.

AI as Force Multiplier, Not Replacement:

“I think of AI as a force multiplier,” Ben emphasized. “But it’s not the silver bullet that’s going to fix broken operations. At least not today.”

The value proposition is compelling: While humans can’t do 100% review at scale, “I kind of love the feeling of peace and comfort that comes if I also have AI do a 100% review on top of the work I’m doing.”

RightRev’s Context-Driven Advantage

Dan highlighted RightRev’s unique position: “We’re at the bottom of a very complex and long process—from pricing and packaging, you’re quoting, you’re going to the contract, you got to bill, you got to collect, and then you finally get to us.”

This comprehensive data access creates powerful opportunities: “The agent with the best data, assuming that you can execute on your building of your agents, is going to be the most powerful agent and the most capable agent. And that’s what we’re excited about… we see everything.”

Critical Evaluation Criteria for AI Accounting Tools

The Data Foundation Question

Both experts agreed: data quality is paramount. Dan noted that RightRev spends “at least half of our time if not more depending on the situation just getting the data cleaned up and getting it into a spot where we can then digest it.”

Ben’s key question for AI providers: “Do you have a capability or tool to make it easy for your user to validate that the data that entered the system is the same as what’s represented in the output?”

Red Flags to Watch For:

1. Overpromising Capabilities:

“We see technologies trying to say they can do a whole lot of things they can’t do and it’s actually quite dangerous.” The reality? “80% of the transactions are actually usually pretty simple to process. It’s always about the 20%, and the 20% is really, really hard.”

2. Vague Use Case Demonstrations:

“When we see a vendor say we can do all of that magically, we say demo it and run through each of your use cases.” Dan recounted working with a $500 million revenue customer who was “hand wavy through the use case thing. We stepped back and said, ‘We need to be really specific here.'”

3. Black Box Systems:

“Black boxes don’t work in rev rec now and they really won’t work with AI. That ability to really transparently see how the calculations are done is really super critical that you have that ability to trace everything through.”

Ben added a fourth consideration: Performance testing and SLAs. “How long will it take to do this processing? How do you respond at scale and at high volume? I feel that a lot of the legacy solutions are more tested in that space, but I don’t always feel that gets enough airtime when people are evaluating products.”

Security and Privacy Considerations

Dan raised important concerns about the current state of AI security: “This is an unproven area. There is really no security for middleware agents that are going across systems today. IT functions are going to be pretty concerned about deploying these things in the wild until there’s really a way to monitor them and have a security program and a security posture around that.”

On data privacy, he drew an interesting parallel: “It sort of feels like privacy back in the mid-2000s when everybody was trying to retain their privacy and we’ve all given up on that. I think at some point in a very safe way, data is going to be needed to be used to train models to make the models better.”

Ben noted the trade-offs in corporate deployments: “You see a lot of embedded AI where it’s actually not allowed to train or retain certain information, which I think is ultimately a good thing, but also kind of plays into where some of these implementations lose ROI because you’re not getting that iterative learning function out of the AI.”

The Future of Finance Roles: From Clerk to Architect

Ben painted a compelling vision of the evolving accountant: “Instead of being the person preparing monthly spreadsheets by the dozens, maybe even by the hundreds, and engaging in manual journal entries, playing catch-up, trying to just survive the next close, I really think people are going to take more of a process and systems view of things.”

The new accountant will need to:

- Understand validation options for AI-informed systems

- Partner closely with auditors on process and context engineering

- Speak strategically to system outputs as a cross-functional business partner

- Maintain an eye toward future business needs and operational enablement

“It’s less reactive and more proactive, looking towards the next thing versus playing catchup 24/7,” Ben explained.

Skills That Will Matter Most

Dan shared his hiring philosophy, which has evolved significantly: “I arguably used to spend more time on the technical skills and I certainly will. But it’s about attitude. Network is super important. And then curiosity, right?”

He emphasized the need for people who “really want to understand our business. They want to understand how it works. And again, when you get into the complexity of the models that are going on today, somebody that can process that complexity, not down at the transaction level, but really at a business level, thinking about how that affects unit economics, how that affects SaaS metrics around go-to-market.”

The bottom line: “The days of the pure clerk are probably going away, and those people are going to uplevel and then the people above them will uplevel and I guess even people like me at the CFO level have to uplevel.”

But Dan cautioned against over-automation: “I don’t have enough people sitting around that understand the business so that if that person ever goes away, the agents aren’t going to run my business because they don’t know my business. They know what they know. I need people that can really understand the inputs that are outside of our data systems that affect our business.”

Practical Advice: Convincing Leadership to Invest

When asked how to convince CFOs to experiment with AI automation, both experts offered strategic guidance.

Ben’s approach: “Framing is really important. What cost am I going to avert with this automation? How much headcount might I be reducing by bringing on one of these systems? Being able to show ownership and understanding of where the trade-offs are, where this could go wrong, what risks am I bringing on as well and why are they worth it.”

He recommended surfacing these ideas proactively: “I think it’s a really interesting possibility to try to surface these ideas before the team gets overloaded and show some of that forward-looking understanding of where the business is going, where things are going to start to break down, and how you’re actually just going to avert that pain altogether.”

Dan’s perspective: “ROI calculators are helpful. I don’t think anybody really puts a lot of weight behind them. I think it’s really going to be more: how do you help my business grow?”

He advocates positioning finance as a growth catalyst: “Every CFO including myself—obviously we’re holding people’s feet to the fire around spending, but ultimately what we’re trying to do is grow. And if we have to in the back office say no because we don’t have the systems, process, skill set, automation to support high scale or just really any level of growth, then we’re really kind of being schizophrenic.”

The key is getting specific: “Really get into the business. Don’t just come in there and do the generic thing. See how they make money. See how complex they are and really be able to translate that to the stakeholders.”

The Extensibility Question: Build vs. Buy

When asked about the future of self-built agents versus software implementations, Dan emphasized extensibility as the answer.

“We’re going to have all sorts of pre-built, very specific agents, but they’re extensible, and you can modify them for your particular use case. And that’s important for use in the wild for mid-market all the way up through the largest of large enterprises.”

This approach serves multiple stakeholders: “For us, we work with the Big Four. We work with all the big SIs. It also allows them to drive professional services revenue. It is super important that they can get in there and do more with your system as opposed to writing scripts. They’re taking an existing agent, modifying it, configuring it a bit, and then moving it forward.”

What’s Next: RightRev’s Product Direction

Dan was clear about RightRev’s strategic focus: “We’re never going to move anywhere near billing and CPQ. We’re the revenue company. And we’re going to do things upstream and downstream from revenue.”

One exciting area? Advanced forecasting for complex revenue models.

“It’s not just seasonality forecasting (that’s kind of easy),” Dan explained. “It’s also not a subscription where you kind of just do the waterfall for all the stuff that’s committed. Those are table stakes today.”

The real challenge and opportunity lies in consumption-based models, particularly for AI companies selling credits: “Instead of ‘set it and forget it’ on the allocations of each of the elements in that contract, that can change not just once during the contract life, but it can actually change monthly, which is all as a result of the fact that you are changing the discount in each period based upon the usage.”

This capability brings FP&A into the revenue recognition process in new ways, enabling real-time visibility into gross margin and unit economics, which are critical for CFOs who need answers before earnings calls, not two weeks after.

Key Takeaways for Finance Leaders:

1. Start with solid operations before layering in AI. Your processes need to work without AI first. Premature AI deployment often exposes operational debt rather than solving it.

2. Demand transparency and auditability. Black box solutions don’t work in accounting, and they definitely won’t work with AI. Insist on the ability to trace calculations and validate outputs.

3. Focus on specific, well-defined use cases. The most successful AI implementations are narrowly scoped and deeply effective, not broadly ambitious and shallowly useful.

4. Prioritize data quality above all else. As Dan emphasized, “The agent with the best data is going to be the most powerful agent and the most capable agent.”

5. Maintain human expertise and oversight. AI should be a force multiplier for skilled professionals, not a replacement. The accountant’s role is evolving from preparer to architect, but business understanding remains irreplaceable.

6. Evaluate performance at scale. Ask vendors about SLAs, processing times, and how their solutions perform at high volume. Legacy solutions may be more battle-tested than cutting-edge AI tools.

7. Think about extensibility. The future likely involves pre-built agents that can be customized for your specific use case, not one-size-fits-all solutions or completely custom builds.

The Bottom Line:

As Ben aptly summarized: “AI is a force multiplier, but it’s not the silver bullet that’s going to fix broken operations. At least not today.”

The most successful finance teams will be those that thoughtfully integrate AI where it adds genuine value, enhancing human judgment rather than replacing it, automating the routine while preserving expertise for the complex, and always maintaining the transparency and auditability that accounting demands.

The technology is advancing rapidly. Recent IBM research suggests that probabilistic AI may eventually achieve accuracy levels approaching materiality thresholds for certain accounting applications. But for now, the winning formula combines AI’s pattern recognition and processing power with deterministic software’s reliability and human expertise’s irreplaceable business context.

As Dan concluded: “More and more of this is moving to real-time, and that is super important. The ability to see how revenue is tracking—and I mean revenue revenue, not bookings—seeing gross margin and unit economics in real-time and helping CFOs do that so it’s not two weeks after… getting that sooner and near real-time is certainly going to be key.”

The conversation between Dan and Ben offers a refreshingly honest look at where AI can genuinely help finance teams today and where it’s not quite ready for prime time. The key takeaway? Start with solid operations, demand transparency, and focus on specific use cases where AI can be a true force multiplier. Month-end close waits for no one, but with the right approach to AI, it doesn’t have to feel like an endless puzzle.

Ready to see how RightRev combines AI innovation with deterministic accuracy for revenue recognition? Request a demo to learn how leading finance teams are automating revenue while maintaining complete audit trails and compliance.