Businesses can breathe a sigh of relief now that FASB has issued updated accounting standards that provide step-by-step guidance on recognizing revenue—a tricky subject. Recognizing revenue is crucial as it helps report financial performance accurately, determine profitability, and maintain transparency for investors and stakeholders.

However, software companies, especially those in the SaaS industry, face their own set of unique challenges when it comes to revenue recognition. Unfortunately, many of these challenges are not directly addressed by the new accounting standards. It’s important for SaaS companies to understand the intricacies of revenue recognition or seek help from a specialized consultant.

That’s why we’ve put together this comprehensive guide to help SaaS and software companies navigate revenue recognition principles and comply with the new standards. Let’s get started!

What Is the Revenue Recognition Principle?

A good place to start is at the beginning. So what does revenue recognition mean in the context of SaaS and software companies anyway? Straight from the Financial Accounting Standards Board (FASB) to you, the revenue recognition principle says that companies should “recognize revenue in a manner that depicts the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for these goods or services.”

In more basic terms, companies should account for revenue while they earn it over time as they fulfill a contract (rather than all at once at the beginning). It’s advisable that they match their transaction price (revenue) with the delivery of goods or services to their customers (AKA their performance obligation or commitment to deliver these tangible and intangible products to clients).

Recording revenue in this way helps ensure that SaaS companies engage in transparent, accurate, and consistent financial reporting.

ASC 606, the revenue recognition standard established by FASB (more details below), is a five-step framework, as seen below:

- First, organizations must identify the customer contract and ensure that it details the rights and obligations of both parties.

- Second, they must determine the performance obligations (i.e., the distinct products or services that will be delivered) within the contract.

- Next, they must establish the transaction price, taking into consideration all variable factors and non-cash components.

- Fourth, companies must allocate the transaction price to each performance obligation based on their relative standalone selling prices.

- Finally, revenue recognition occurs as the performance obligations are met and control is transferred to the customer.

These five steps collectively provide a comprehensive framework for consistent and transparent revenue recognition across industries and various types of contracts.

What Does ASC 606 Mean for SaaS Companies?

Back in May 2014, FASB and the International Accounting Standards Board (IASB) rocked the business world when they issued ASC 606—altering the revenue recognition standard for companies in more ways than one. For example, ASC 606 ushered in a new five-step framework that explained how to record revenue and standardized financial reports to make them easier to compare. It required more disclosures to give auditors additional color behind company metrics.

When it comes to SaaS revenue recognition, in particular, ASC 606 matters for several reasons:

- It compels companies to follow FASB revenue recognition guidelines to produce audit-ready financial statements

- It creates a more consistent financial and revenue reporting experience

- It explains how to include contract assets (i.e. unbilled receivables) and contract liabilities (i.e. deferred revenue) in MRR calculations

- It encourages investors to consider more general accounting metrics rather than only focusing on SaaS-related ones like ARR, MRR, and CAC

- It motivates businesses to create a documented revenue policy

ASC 606 can certainly prompt SaaS and software companies to reevaluate their contracts and delivery methods. They must pay particular attention to how they recognize revenue when their contracts involve multiple performance obligations (like providing ongoing customer support and/or maintenance services).

Noncompliance can lead to several negative consequences, including penalties, fines, legal action, and/or a loss of investor confidence.

The State of Revenue Recognition in SaaS

In the context of SaaS, revenue recognition hinges on fulfilling performance obligations, which often involve providing software over time. SaaS and software companies must diligently assess and allocate revenue for each performance obligation within their contracts, reflecting the distinct product(s) or services they offer to customers. This process requires a keen understanding of delineating multiple performance obligations and recognizing revenue accordingly.

As the SaaS industry continues to change, companies must stay attuned to the Financial Accounting Standards Board’s guidance, and effectively managing their performance obligations will be vital in maintaining consistent and compliant revenue recognition practices.

What Are the Major Differences Between ASC 606 and IFRS 15 in Software and SaaS Entities?

While ASC 606 pertains to U.S.-based companies, its counterpart, IFRS 15, developed by the International Accounting Standards Board (IASB), applies to most non-U.S. jurisdictions. Together, ASC 606 and IFRS 15 standardize the revenue recognition process companies worldwide use to account for revenue.

Although the two standards complement each other, there are some notable differences between them, particularly when it comes to SaaS and software businesses. Part of this is that ASC 606 is a framework under Generally Accepted Accounting Principles (GAAP), while IFRS 15 is not.

Let’s break it down even further.

Principal vs. Agent Consideration

ASC 606 provides more detailed guidance on assessing whether a company acts as a principal or an agent in a contract. The principal recognizes the gross amount of consideration as revenue, while the agent only recognizes the net amount as revenue.

IFRS 15, meanwhile, focuses more on controlling goods and services rather than the principal-agent relationship. It provides indicators to determine when an entity acts as the principal or agent.

Cost Capitalization

Under ASC 606, certain incremental costs of obtaining a contract can be capitalized if they are expected to be recovered.

IFRS 15 does not have specific guidance on capitalizing contract acquisition costs. Costs directly attributable to obtaining a contract are generally expensed when incurred unless other standards cover them.

Sales Taxes

For ASC 606, sales taxes collected from customers are excluded from the transaction price and, therefore, not considered revenue.

IFRS 15 allows entities to present sales taxes either on a gross basis or a net basis (as an agent) as long as certain criteria are met.

Contract Modifications

Under ASC 606, contract modifications are considered separate contracts if they result in distinct goods or services. If not distinct, the modification is treated as a continuation of the existing contract.

IFRS 15 assesses whether a modification results in a “new” or “changed” performance obligation. New obligations are treated as separate contracts, while changed obligations are considered part of the original contract.

Collectibility

ASC 606 has specific criteria for evaluating the collectability of consideration, which must be probable.

IFRS 15 does not have a separate collectability threshold; instead, it focuses on the probability of collecting the consideration to which the entity is entitled.

It’s important to note that both standards require that revenue be recognized only when it is probable that the consideration will be collected. If collectability is not probable, the related amount will continue to be recognized as deferred revenue until the criteria are met.

Presentation of Revenue

For ASC 606, presentation requirements for recognizing revenue in the income statement are more detailed under ASC 606.

IFRS 15 provides more flexibility in presentation, which may lead to differences in how revenue is displayed in financial statements.

Revenue Recognition Scenarios for SaaS Companies

Given the recurring nature of most SaaS offerings, revenue recognition can quickly become complicated due to factors like varying subscription terms, usage-based billing, and contract modifications. Establishing clear and comprehensive revenue recognition policies within the organization can help guarantee accurate financial reporting and compliance with ASC 606 and IFRS 15.

Well-defined policies outlining when and how revenue should be recognized should be crafted. These policies should address various scenarios, including upfront fees, recurring subscription charges, usage-based billing, and other revenue streams unique to the SaaS model.

Additionally, SaaS companies should maintain detailed records. Accurate and comprehensive documentation of customer contracts, payment terms, subscription changes, and service delivery timelines enables businesses to demonstrate compliance with revenue recognition standards. This supports accurate financial reporting and helps mitigate potential disputes with customers or regulatory authorities.

Fulfilling disclosure requirements is another important aspect of achieving revenue recognition compliance. When financial statements are transparent about revenue recognition policies, the impact of contract modifications, and the method of recognizing revenue, stakeholders gain more insight into the company’s revenue-generating activities. This builds trust and confidence among investors, analysts, and regulators.

SaaS Scenario 1: Multiple Element Arrangements

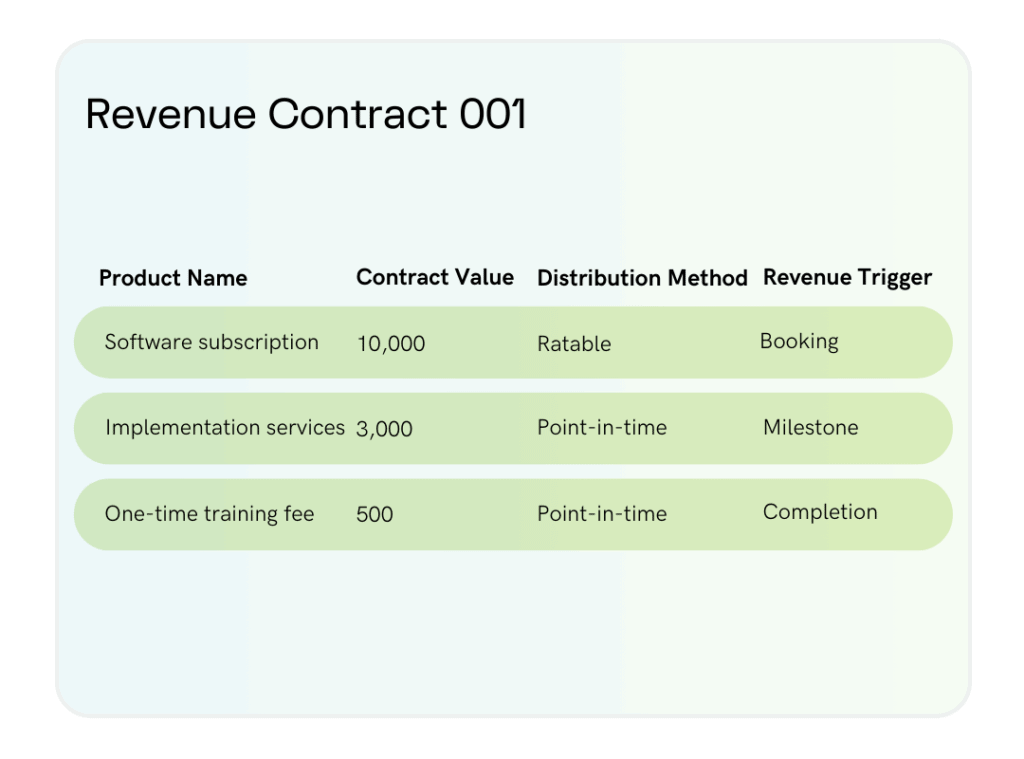

Let’s imagine a SaaS company that provides a sophisticated project management platform to businesses of all sizes. In this scenario, the company offers its customers a cloud-based software subscription in addition to a service charge for implementing the software and a one-time training fee. The software subscription, implementation services, and training are three distinct obligations but bundled in the same customer contract.

In this case, revenue recognition requires a multifaceted approach because of the multiple elements involved in the contract. Since the software subscription plan is made available to the customer at the start of the twelve-month contract, this leads to immediate revenue recognition upon the start of the subscription period, which is carried out evenly over the duration of the contract term. Meanwhile, revenue recognition for the implementation services must be allocated over the project’s duration, in this example, according to project milestones. Finally, revenue for the one-time training would be recognized based upon the completion of the training.

This multi-layered revenue recognition approach, encompassing the subscription, implementation services, and a one-time training fee, shows just how much SaaS companies have to contend with in order to produce accurate and compliant revenue recognition reporting.

SaaS Scenario 2: Frequent Contract Modifications

SaaS contracts often evolve to accommodate changing customer needs or business circumstances. Subscription upgrades, downgrades, cancellations, price adjustments, and other modifications can all have significant implications on revenue recognition.

Companies must be able to identify contract modifications in a timely and accurate manner and continually weigh their impact on revenue recognition. This often requires cross-functional collaboration between finance, sales, legal, and customer success teams. By working together, these teams can ensure that any adjustments to contract terms are accurately reflected in revenue recognition practices.

Utilizing revenue recognition software that can automatically calculate and account for revenue when different contract amendments take place is also a huge help. RightRev’s intelligent rules engine, for instance, easily handles the most common types of contract changes, in addition to automatically reallocating revenue across performance obligations in real-time as the changes occur.

Finally, regularly reviewing and updating revenue recognition practices is always a good idea, particularly when customer contracts change. Since the SaaS landscape is dynamic and customer relationships are constantly evolving, existing revenue recognition policies may need adjustments to align with the changing contractual arrangements. By staying vigilant and proactive in revisiting these policies, SaaS companies can ensure revenue recognition practices stay in line with business realities and accounting standards.

How Can SaaS Companies Comply With ASC 606?

Finally, to the big question everyone wants to know—how can a SaaS business maintain ASC compliance?

First, they should follow a structured approach in evaluating their revenue recognition practices. This includes identifying all customer contracts and determining the promised goods and services (AKA performance obligations) within each contract. Proper determination for when and how to recognize revenue for every scenario is key to automating the process and ensuring compliance with ASC 606 or IFRS 15.

This might not be as simple as it sounds—the distinct performance obligations, pricing structures, and time frame over which the services will be delivered all matter. Then, the revenue should be allocated to these obligations based on their relative standalone selling prices, commonly referred to as SSP.

SaaS companies should also clarify when control over the promised goods or services is transferred to the customer. This often involves tracking milestones, usage metrics, or completion criteria as specified in the contracts. Any variable consideration, such as discounts, refunds, or performance-based incentives, should also be estimated and accounted for appropriately.

Unfortunately, non-compliance with ASC 606 can lead to several risks and penalties. For one, financial misstatements can damage investor trust and lead to legal consequences.

Secondly, regulators might impose fines and penalties or even initiate legal actions against the company and its executives. Additionally, non-compliance can result in the company misinterpreting its financial health and making poor strategic decisions.

To avoid these risks, SaaS and software companies should invest in robust accounting systems and personnel with a strong understanding of ASC 606 or utilize automated accounting software that recognizes the importance of modernizing revenue management. Thorough documentation of contract terms, performance obligations, and revenue recognition methods is essential.

Regular internal audits can also help identify discrepancies and ensure ongoing compliance. Finally, seeking external expertise from auditors or consultants with experience in ASC 606 can provide an additional layer of assurance.

Challenges of Revenue Recognition in Software and SaaS Entities

One of the key hurdles SaaS companies often face arises from the prevalent recurring revenue models in the industry. Such models necessitate the proper allocation of revenue over time, posing difficulties in determining the appropriate timing of revenue recognition.

Long-term contracts also add further complications as companies must consider performance obligations and allocate revenue accordingly, often spanning several years. Evolving business practices compound the challenges, with emerging pricing structures and contract modifications forcing entities to reevaluate their revenue recognition strategies.

When companies offer bundled services, software licenses, or maintenance agreements to customers, it adds another layer of complexity. Distinguishing between separate performance obligations within a bundled offering requires careful consideration to allocate revenue for each element accurately.

This challenge becomes bigger when a customer’s ability to benefit from each element varies. To address these issues, entities need comprehensive systems and processes to track and allocate revenue across various components of bundled offerings.

How RightRev Software Can Make Compliance Easier

For SaaS and software companies, it’s important to address and overcome revenue recognition challenges, including the contract intricacies that are common in their industry. Ignoring this critical area can result in serious consequences, such as fines, legal problems, and reputational damage. Also, keeping up with changing accounting practices and standards requires an ongoing effort to maintain ASC 606 compliance.

Automating your revenue recognition process will not only ensure accurate revenue calculations and compliance but also alleviate the headaches associated with manual revenue recognition and accounting for every contract modification in spreadsheets—leaving much more time (literally tons of hours!) to focus instead on strategic initiatives that drive growth for the business.

Thankfully, RightRev is ready and willing to help companies navigate these ever-evolving and sometimes treacherous waters. If your SaaS or software company needs this type of automation, contact RightRev today to find out how its fully configurable and ASC 606-compliant subscription revenue software can help.