The Hidden Operational Cost of Lessor Accounting

Lessor accounting applies when a company provides customers with the right to use physical assets, including hardware, dedicated infrastructure, or embedded equipment within service contracts.

For many technology companies, lessor accounting is already required under ASC 842, but is not operationalized. The result is inconsistent lease classification, audit friction, and manual rework during close, especially when contracts bundle hardware, usage-based pricing, or global reporting requirements.

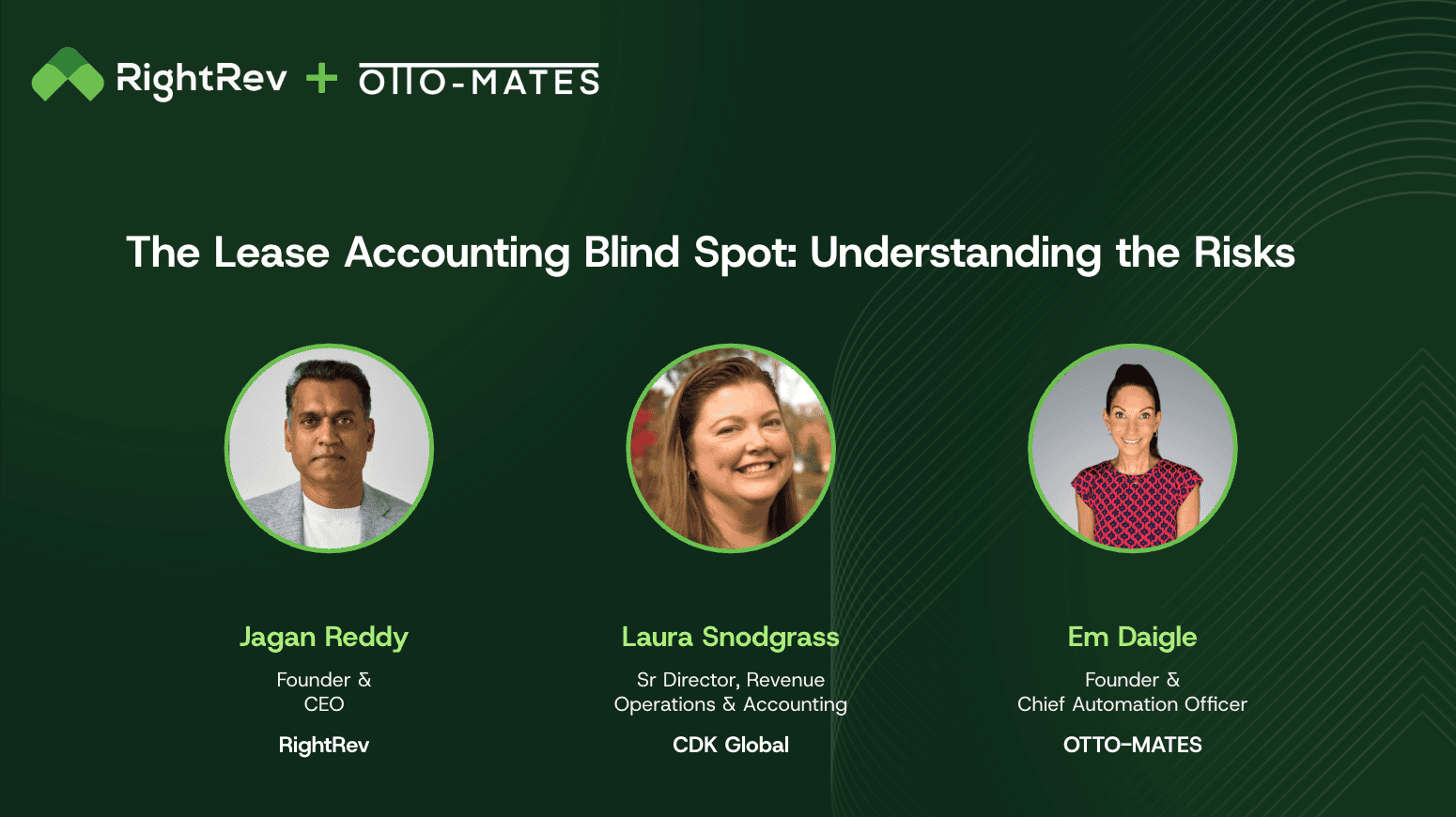

In a recent webinar, RightRev CEO Jagan Reddy and CDK Global’s Senior Director of Revenue Operations and Accounting discussed how lessor accounting shows up in real technology contracts, where teams run into trouble, and what it takes to manage embedded leases at scale.

We take a detailed look at the key insights from that conversation and what they mean for finance teams navigating the lessor accounting challenge.

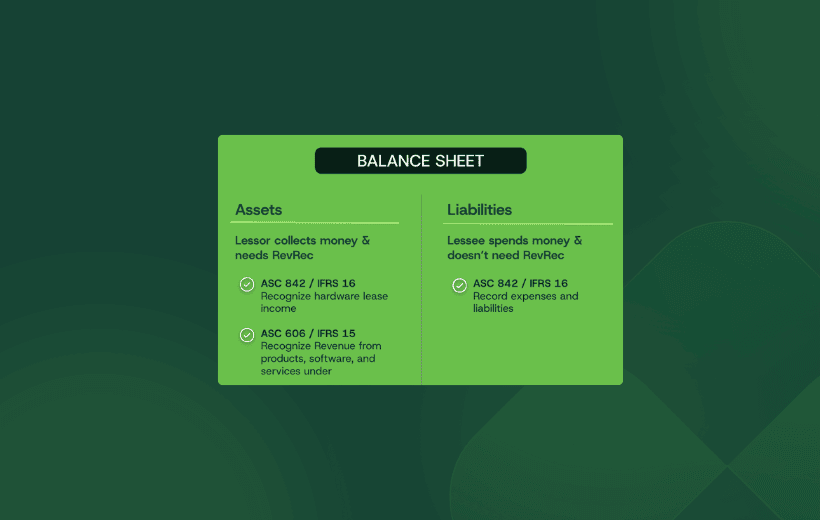

The Lessee-Lessor Imbalance

When most finance teams think about lease accounting, they think about ASC 842 from the lessee perspective, tracking office space, company vehicles, and equipment leases. The software market reflects this reality. Dozens of solutions exist to help companies manage their lease liabilities.

But what about the other side of the equation?

For technology companies that deliver hardware alongside software, such as printers, servers, networking equipment, and IoT devices, lessor accounting presents a fundamentally different challenge. It introduces operational and systems complexity that traditional lease tooling and spreadsheet-based processes cannot support at scale.

Lessee accounting solutions are abundant because the problem is relatively standardized. Companies lease assets, track payment obligations, and recognize right-of-use assets on their balance sheets. The accounting follows predictable patterns, and the volume is high enough to justify purpose-built software.

Lessor accounting is different.

“Every time we talk about lease accounting and when a vendor says ‘we support lease accounting,’ a lot of customers fail to ask a question: are you supporting the lessee side or the lessor side?” Jagan Reddy explained. “There are two sides of the coin.”

The lessor side is more variable, more complex, and more tightly integrated with billing, asset management, and revenue recognition. It is not one problem. There are many problems shaped by different asset types, pricing structures, and business models.

As Reddy put it, “On the lessor side, you need to figure out your asset type and your pricing structure. Is it fixed, variable, stepping up, CPI-linked? There are many variations, and you are estimating residual value. For lessor accounting, it is extremely complex.”

Where Revenue Recognition and Lease Accounting Collide

One of the most disorienting aspects of lessor accounting for finance teams is how deeply it intersects with revenue recognition.

Under ASC 606, revenue is recognized as control transfers to the customer. Under ASC 842, lease accounting focuses on that same concept of control, but applies it to physical assets embedded in service contracts.

The result is that a single contract can contain both lease and non-lease components, each requiring different accounting treatment.

“The accounting intersects with revenue patterns, interest income, variable consideration, contract modifications, concessions, and collectibility,” Reddy noted. “Then you are classifying leases and separating leases from non-lease components in contracts. This creates a lot of complexity for users that operate both systems together.”

For companies delivering hardware as part of a broader technology solution, this creates a fundamental challenge. The data required for lessor accounting is spread across multiple systems:

- Contracts may live in order management systems

- Billing schedules exist in billing platforms

- Asset information sits in subledgers

- Pricing and SSP calculations happen in CPQ tools, ERPs, or point solutions

Manual workflows tend to break once contract changes require multiple systems to stay in sync.

The Hidden Complexity: Embedded Leases

Even more challenging than explicit lease contracts are embedded leases, which are lease arrangements hidden within service agreements.

This is increasingly common in technology contracts involving servers, cloud capacity, data centers, and AI infrastructure. The determining factor is not how the contract is labeled, but whether the customer controls the use of an identified asset.

“Embedded leases often hide in plain sight,” Reddy explained. “Especially in server hosting, private cloud, colocation bundles, and capacity-based arrangements. The key question is whether the customer controls the use of an identified asset.”

If a contract explicitly or implicitly specifies which server, rack, or cluster will be used, and the customer controls what runs on it and receives substantially all the benefits, the arrangement can qualify as a lease, even if the contract is labeled as managed hosting or services.

Identifying Embedded Leases in Practice

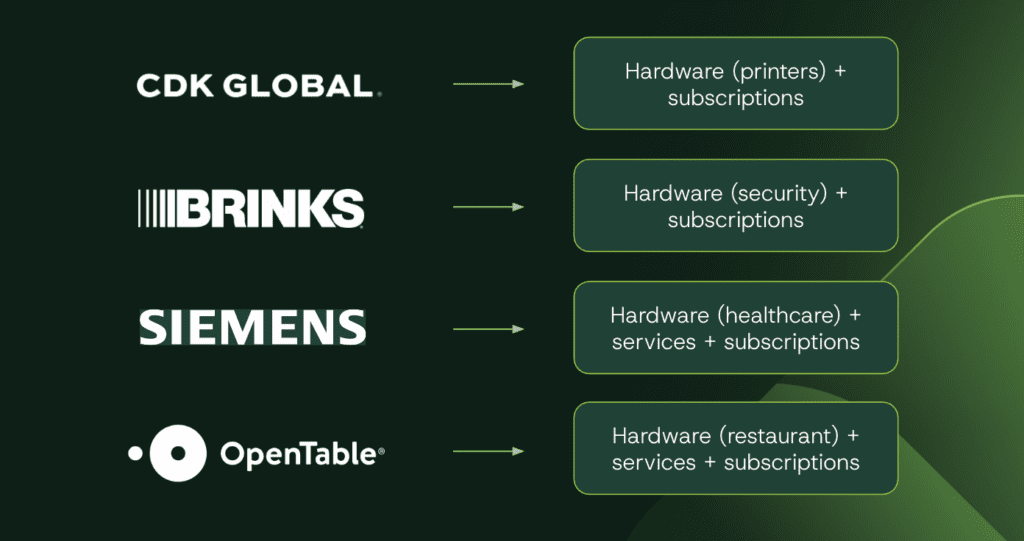

At CDK Global, Laura and her team manage this assessment at scale. They deliver printers, networking equipment, and other hardware to automotive dealerships as part of integrated technology solutions.

“We actually maintain control of a lot of our embedded assets in our contracts because of the way we use them for the customer and the way we manage networking services for them,” Laura explained. “That is what they want us for. They want us to come in, set up their networking, and control it so they can sell cars.”

The control assessment is where judgment starts to matter, and where finance teams often have to defend their position to auditors.

“We do not always agree with our auditors,” Laura noted. “There is some gray space where there is not a black-and-white answer in the literature. Even when you move from company to company, you want to understand the auditors’ perspective.”

Examples of bundled contracts with lease components:

Warning Signs to Watch For

When reviewing contracts for embedded leases, finance teams should look for specific signals:

- Keywords such as “dedicated,” “reserved,” “named hardware,” or “single-tenant cluster”

- Customer decision rights over what workloads run, when they run, and how much they run

- Capacity commitments tied to specific infrastructure

- Substitution rights, including whether the provider can swap assets without customer approval

“These are the signals customers tell us they look for when determining whether there is an embedded lease,” Reddy said.

The Shift from Subscription to Usage-Based Models

The rise of AI and changing go-to-market strategies are making embedded lease questions more frequent and more urgent.

As companies shift from traditional subscription models to usage-based pricing, consumption billing, and hybrid approaches, the distinction between service access and asset control becomes harder to draw.

“This embedded lease question comes up more often now,” Em Daigle of Otto-Mates observed. “A position you took previously may no longer hold if the way you go to market changes.”

For software companies that historically delivered everything digitally, the introduction of physical components, even something as small as a USB device or IoT sensor, can trigger lease accounting requirements.

“Traditional views have changed as the market has changed,” Laura noted. “Software companies now blend equipment and services in ways we did not see before.”

Why Payments Matter More Than You Think

One of the more counterintuitive aspects of lessor accounting for revenue accountants is the role of payment timing.

In ASC 606, payment timing typically does not change when revenue is recognized. A payment received late does not alter the revenue pattern.

In lessor accounting, payment timing can directly affect interest income calculations.

“Invoicing matters in 606, not payments,” Reddy explained. “In lessor accounting, payments matter much more. The timing of cash affects how interest is calculated.”

This creates a dependency that many revenue systems are not designed to handle. The lease accounting engine must account for when cash is received, not just when invoices are issued.

The Excel Breaking Point

For many finance teams, the need to automate lessor accounting becomes clear during an audit or during month-end close, when manual processes become unsustainable.

Laura described two key pressure points at CDK. The first is separating revenue and cash flows from contracts sold as a single package.

The second is contract modification.

“If you have longer-term contracts with price updates, early extensions, or customer transfers, the entire accounting picture changes,” Laura explained. “You have to recalculate everything.”

Managing a small number of leases in Excel is possible. Managing thousands with varying terms and modification histories is not.

The Compounding Effect of Variability

As complexity and scale increase, traditional lease accounting software breaks down.

Late payments, inconsistent terms, and unique fact patterns make it difficult to apply conclusions consistently across a portfolio. Without automation, every contract becomes a custom exercise.

Maintaining consistency under these conditions becomes a full-time effort.

How RightRev Approaches the Lessor Accounting Challenge

RightRev’s approach is based on a clear principle. Lease accounting and revenue recognition are connected, but they must remain independently governed.

“We wanted the systems to share data without forcing one to rewrite the other,” Reddy explained.

Key capabilities include:

- A unified data model shared between revenue and lease workflows

- Embedded lease signal detection with user-driven classification

- Configurable classification rules supporting ASC 842 and IFRS 16

- Automated separation of lease and non-lease components

- Calculations for net present value, interest income, and principal reduction

The Business Impact

At CDK Global, automating lessor accounting improved operational efficiency and clarity.

Benefits included reduced manual close effort, faster modification handling, consistent classifications, and audit-ready documentation.

“Eliminating spreadsheets and simplifying processes has helped us stay manageable,” Laura said.

Key Lessons for Finance Teams

- Identify embedded leases early.

- Treat lessor accounting as a cross-system workflow.

- Enforce consistency while preserving judgment.

- Account for payment timing explicitly.

- Move beyond spreadsheets before variability compounds.

The Bottom Line

Lessor accounting in technology companies differs materially from lessee accounting. Embedded leases, contract variability, revenue interaction, and payment dependencies make manual approaches unsustainable.

Teams that invest early in scalable systems and disciplined processes are better positioned for compliance and strategic insight.

If you are ready to move beyond spreadsheets and address lessor accounting with confidence, request a demo to see how RightRev can help.

Interested in learning more about lease vs lessor accounting? Watch our CEO, Jagan Reddy, talk about it with CDK Global in our most recent webinar.