For more than a decade, finance teams have been promised “end-to-end transformation.” Yet most of that transformation stopped at quoting, contracting, and billing. Revenue Recognition (the function that determines the single most important number on your P&L) was left until last, treated as a compliance chore rather than a strategic lever.

Today, that old operating model is collapsing.

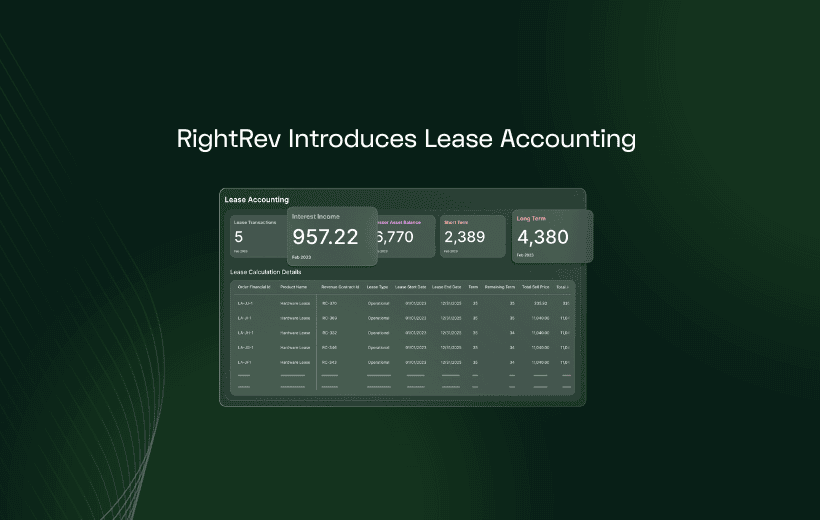

The rise of flexible monetization, the pressures of ASC 606/IFRS 15, and the acceleration of AI are forcing companies to rethink how their entire lead-to-revenue ecosystem works. The new reality is clear: RevRec can no longer be an afterthought; ultimately, it’s the mechanism that determines how fast you can innovate, scale, and grow.

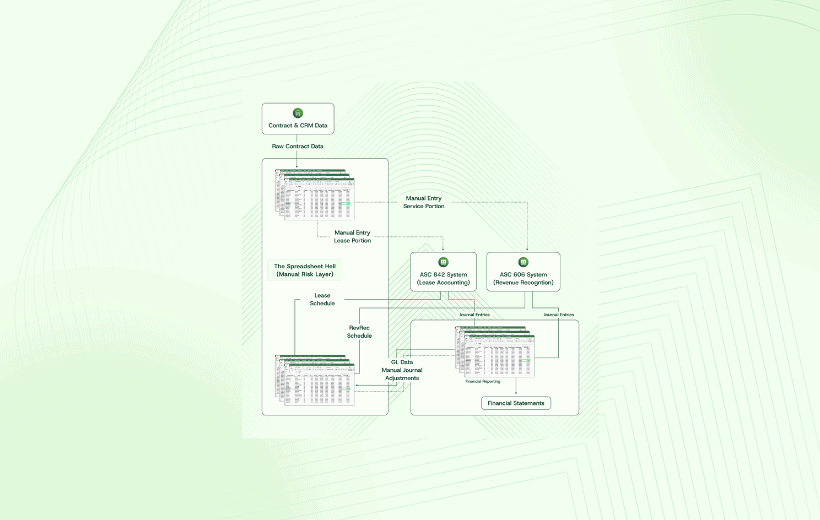

The System Breakdown That Forces Finance Back to Spreadsheets

This shift sounds straightforward in theory. But in practice, most companies hit the same wall. Despite heavy investments in modern quoting, billing, and ERP systems, finance teams inevitably find themselves back in Excel, manually reconciling the gap between what the business sold and what the systems can recognize.

Most companies recognize this pattern:

- You invest heavily in quoting, billing, and ERP systems.

- You evolve your pricing and packaging strategy.

- The systems can’t support it.

- Teams revert to Excel for the final 10% of revenue that never quite fits into standard logic.

- Revenue calculations start happening outside the system.

- The ERP becomes a ledger (accurate but unintelligent).

Pricing experiments like bundles, usage-based models, hybrid monetization, and outcome-based fees are no longer “edge cases.” They are the expectation. Customers want flexibility. Product wants speed. Pricing teams want room to test and iterate.

But every upstream change puts 30× pressure on the revenue accounting team. A single pricing adjustment ripples downstream through contract interpretation, SSP allocation, fair-value rules, performance obligation mapping, and reporting granularity.

This is where innovation breaks. The systems were built for subscription simplicity, not pricing complexity.

Modern Pricing Requires Modern Revenue Architecture

The biggest misconception in Quote-to-Cash today is the belief that everything starts with CPQ and Billing. That was true a decade ago; it’s not true now.

Quoting and billing are mostly solved problems (don’t get us wrong, there are still headaches here, but sophisticated solutions exist) for almost all pricing models.

Revenue Recognition is now the bottleneck. But forward-thinking finance leaders start their entire revenue architecture with RevRec and reporting and work upstream, not the other way around.

When RevRec is the anchor:

- Pricing teams can experiment freely.

- Sales can introduce new bundles and SKUs without operational debt.

- Billing can invoice without bespoke workarounds.

- Finance can maintain compliance while enabling speed.

This approach is exactly why companies like Snowflake can change their monetization models multiple times a year without disrupting the business. They start every pricing decision with revenue recognition rules, then propagate those requirements into quoting, billing, and upstream systems.

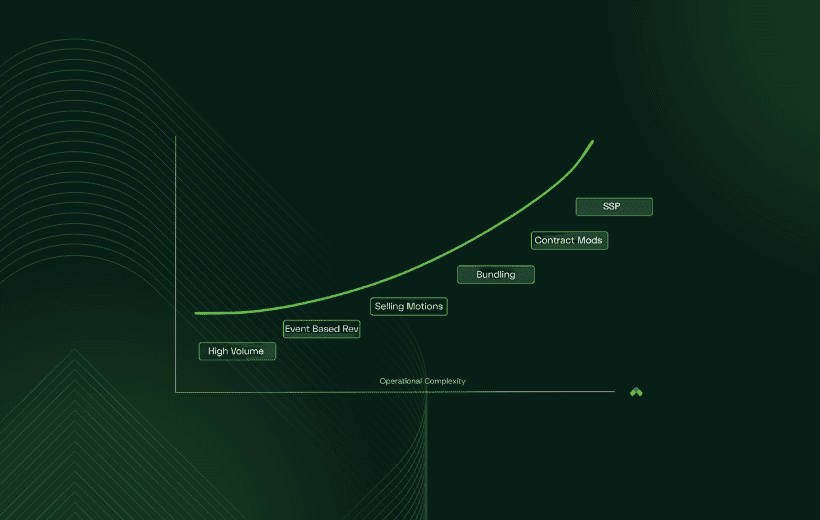

Revenue Complexity Happens Fast, Even in “Simple” Businesses

If you have only a handful of products or a straightforward retail-like model where revenue is recognized upon shipment or sale, then Rev Rec is simple.

But anything beyond that quickly becomes complex. You might have just one product, but extremely high transaction volume—think Netflix or Spotify: few SKUs, but massive scale in events.

Or you might have a business with highly varied pricing and packaging models (like Snowflake or Salesforce) where each pricing experiment introduces new revenue policies, new allocation rules, and new transaction events that all must be handled correctly.

Complexity doesn’t come from the number of products alone. It comes from the nature of the business model, the volume of events, and the variability of pricing and packaging. Complexity isn’t about the number of products. It’s about:

- High transaction volumes (e.g., Netflix, Spotify)

- Highly variable pricing models (e.g., Snowflake, Salesforce)

- Frequent packaging changes

- Hybrid monetization across subscriptions, usage, and services

Even one product can create enormous downstream complexity when pricing is flexible and event-driven. And once complexity begins, it compounds quickly.

This is why designing your revenue architecture around the ASC 606 five-step model is essential. RevRec is not a policy exercise; it’s the connective tissue between your entire Q2C workflow and how your company recognizes, reports, and forecasts revenue.

The New Mandate for CFOs: Connect Pricing to Revenue Reporting

CFOs who treat Revenue Recognition as a compliance function miss the bigger picture.

CFOs who treat it as a strategic function:

- Create alignment from customer wallets to investor reporting

- Enable the business to price however customers want to buy

- Support evolving sales motions—PLG, usage-based, enterprise, services—without operational drag

- Ensure compliance while giving the business freedom to innovate

- Build a RevRec-first architecture that scales instead of breaking

In other words, they become the catalyst for profitable growth. Not blockers. Not backstops. Catalysts.

The Takeaway: Build Your Tech Stack on Top of RevRec, Not Around It

The companies that win the next decade will recognize one truth early:

Pricing innovation is only as fast as your Revenue Recognition architecture.

AI will only be as smart as your revenue rules and data.

Start with RevRec. –> Build your pricing, CPQ, billing, and –> add AI strategy on top of it.

Give your business the freedom to monetize anything, and trust that finance can recognize everything.