The subscription wave has finally hit hardware. Anything-as-a-Service (XaaS) and Hardware-as-a-Service (HaaS), any acronym you use, has transformed hardware companies into recurring revenue businesses overnight. That’s good for growth but it quietly changes your job: lease accounting becomes a core finance process, not a niche disclosure line. At its simplest, lease accounting is how you identify, measure, and recognize the income, assets, and obligations that arise when you let customers use your equipment over time (ASC 842/IFRS 16), alongside the revenue from software, services, and usage fees in the same contract (ASC 606/IFRS 15).

On the systems side, you’re not starting from zero. Most hardware companies already run a revenue recognition engine, billing, and an ERP to manage ASC 606 and the rest of the revenue stack. And over the last decade, an entire industry of lease accounting software has emerged to help companies adopt ASC 842 and IFRS 16.Yet almost all lease accounting software was built for the lessee, the party spending money, not the vendor earning lease income. These systems track liabilities and ROU assets, not lease income and revenue schedules working together.

But it comes with a hidden consequence almost no one prepared CFOs for:

The moment you bundle hardware + software + services, you become a lessor.

And suddenly, ASC 842/IFRS 16 and ASC 606/IFRS 15 are both your lease accounting problem.This results in a widening compliance gap at the core of the hardware XaaS model.

Where, the fastest-growing part of your business is now most exposed to:

- Compliance risk

- Material misstatements

- Failed audits

- Slower close cycles

Why Hardware XaaS Turns You Into a Lessor

XaaS, HaaS and EaaS models aren’t just “pricing innovation.” They change the nature of the hardware sale to include an embedded financing element. When you give a customer the right to use a physical asset over time, you’ve entered lessor territory, the domain governed by ASC 842 / IFRS 16. ASC 842 are accounting rules for how lessors record lease income; ASC govern US rules and IFRS govern International rules.

Meanwhile, the software, services, support, usage, or outcome-based fees in that same contract fall under ASC 606 / IFRS 15. ASC 606 are accounting rules for how companies recognize revenue for products, software and services.

A single XaaS contract now creates two accounting streams:

1. Lease income on the hardware under ASC 842 / IFRS 16

- Operating lease

- Sales-type lease

- Direct financing lease

Each classification changes when income hits your P&L and what stays on your balance sheet.

2. Revenue on the non-lease components under ASC 606 / IFRS 15

- Software subscriptions

- Cloud services

- Maintenance & support

- Usage or overage fees

- Professional services

And here’s the kicker: FASB and IASB requires lessors to separate and allocate the contract between lease and non-lease components before recognizing anything. FASB (Financial Accounting Standards Board) is the US organization that sets and maintains ASC standards. IASB (International Accounting Standards Board) is the global organization that sets and maintains IFRS standards.

This is where legacy systems break.

Why Legacy Systems Break: Two Standards, One Contract, No Single System

For a U.S. hardware CFO monetizing its products with a lease structure, the real issue isn’t “842 vs. 606.” And, for global CFO’s it isn’t “16 vs. 15”. We’ll speak to ASC in our examples but the same applies to IFRS.

The real problem is that both standards apply to the same contract and they must remain synchronized over the entire life of the deal.

ASC 842 was designed to align with ASC 606, because lease income must follow revenue recognition principles. But in practice, most companies implemented them as separate projects. This creates the disconnect we see today:

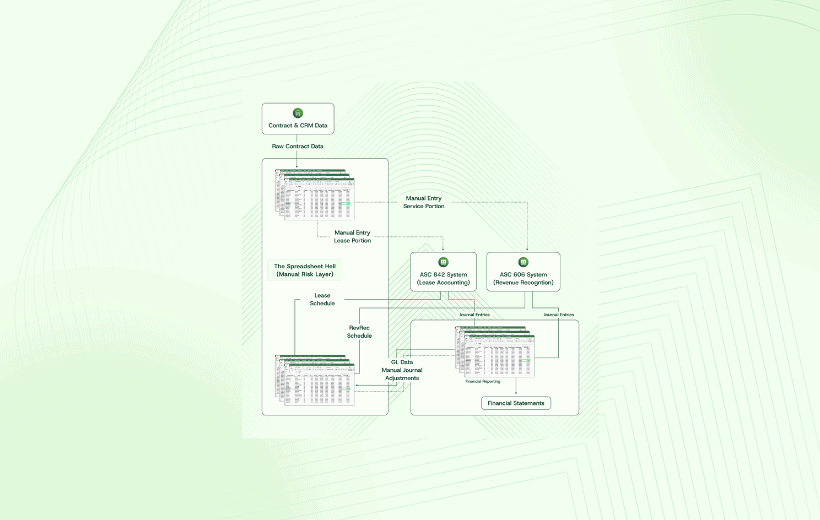

- A lessee-focused 842 tool or ERP module to tick the “lease standard” box, often oriented to ROU assets and lease liabilities.

- A revenue recognition engine or custom ERP rules for ASC 606.

- A spreadsheet and associated manual process in the middle to do the separation and allocation work for bundled hardware + software + services.

For every XaaS, HaaS, EaaS contract, Finance now has to:

- Identify lease and non-lease components.

- Determine their standalone prices and allocate the transaction price (using ASC 606 rules).

- Build and maintain two sets of schedules—lease income and revenue—off that allocation.

- Keep both sets of schedules in sync as contracts change.

When each of those steps lives in a different system, connected by Excel and emails, you have a structural compliance gap:

- No single system owns the full contract.

- No single engine owns the allocation logic.

- No single audit trail shows how a sales change flowed through both 842 and 606.

- No single view of holistic (lease and subscription) revenue and deferred revenue

On Day 1, a strong accounting team can brute-force the answer.

On Day 2, the model doesn’t scale and compliance breaks.

Day 2: Where Lease Accounting Compliance Risk Really Spikes

Most XaaS misstatements don’t come from the initial contract setup. They show up when contracts change. Every extension or early renewal, device add or scope reduction, hardware refresh or upgrade, CPI/index reset, usage-tier change, or pricing restructure can trigger a remeasurement under ASC 842 and a reallocation under ASC 606.

Each time that happens, your team has to do the same heavy lift: reassess the contract and remaining consideration, reallocate that consideration between lease and non-lease components using current SSPs, update both lease income and revenue schedules, and push consistent updates into every affected system.

In a disconnected stack, one seemingly simple modification quickly becomes a fragile workflow. The 842 side gets rebuilt in a complex Excel model. The 606 side requires a separate configuration change or offline model. Multiple manual journal entries are then keyed into different subledgers or the GL, followed by a reconciliation exercise at quarter-end to make everything tie.

From the CFO’s seat, it shows up as three things: unpredictable closes, tougher audits, and hidden misstatement risk. Quarters with a lot of contract changes are harder to close and require more last-minute adjustments. Auditors lean into the spreadsheets, allocation logic, and unexplained “black box” true-ups. And a single misapplied modification can quietly ripple through lease income, recurring revenue, and disclosures long before anyone spots it in the financials.

You often don’t see the problem until it’s embedded in your financials.

Why Existing Lease Accounting Software Fails XaaS Lessors

“The market has plenty of solutions for lessees—what it lacks is a system built for lessors who must recognize both lease income and revenue. This is why we built the first Lease Accounting engine for lessors.” Jagan Reddy, CEO RightRev

Most lease accounting tools were built for lessees, not lessors and designed to track ROU assets, liabilities, and disclosure reports, not lease income or ASC 606 revenue. As hardware companies adopt XaaS, HaaS, and EaaS models, they become lessors overnight. But today’s tools: Oracle, SAP RE-FX, NetSuite, LeaseQuery, Visual Lease, Nakisa, EZLease, MRI, NetLease, all remain architected as standalone ASC 842 subledgers with no native ASC 606 engine. They can’t separate or allocate bundled hardware + software + services, can’t run 842 and 606 together, and collapse under high-volume device portfolios or Day-2 changes like upgrades, CPI resets, and refresh rights.

This forces the office of the CFO into a patchwork of systems and spreadsheets where mismatches, remeasurements, stale schedules and audit issues quietly accumulate. This is the lessor accounting gap, and no legacy system solves it.

The market is full of solutions for lessees, but none built for lessors who must recognize both lease income and revenue, which is exactly why we built the first purpose-built lessor accounting engine!

The CFO Impact: Control Risk in Your Fastest-Growing Revenue Stream

When your XaaS, HaaS and EaaS lines grow double digits, the combination of complex contracts and manual accounting creates a dangerous risk profile:

Control risk

- Heavy reliance on spreadsheets and manual judgment around allocation, modifications, and variable payments increases the likelihood of control deficiencies and material weaknesses.

Financial statement risk

- Lease income, recurring software revenue, and usage-based fees can be misstated if 842 and 606 aren’t updated consistently from the same events and assumptions.

Operational drag

- Finance teams spend time reconciling systems and building custom reports instead of analyzing unit economics and supporting new commercial structures.

Strategic friction

- Go-to-market teams are constrained in what they can offer because Accounting is rightly worried about whether complex bundles and refresh structures can be supported without increasing audit risk.

The compliance gap in XaaS accounting is simple: Your revenue model has modernized, but your lease accounting systems haven’t. The underlying lease accounting is still stitched together with tools that were never built for lessors.

Why RightRev Built The Lessor Accounting Platform

RightRev started in the world of complex ASC 606 automation: bundled arrangements, high-volume billing, usage-based models, and frequent contract modifications for technology and equipment vendors.

As customers shifted to XaaS, HaaS and EaaS structures, we saw the same pattern again and again:

- Hardware was effectively being leased under ASC 842

- Software, services, and usage were recognized under ASC 606

- The interaction between the two was held together by spreadsheets, tribal knowledge, and manual journals

The conclusion was clear: As long as lease accounting and revenue recognition live in separate systems with separate engines, hardware CFOs will be carrying unnecessary compliance and operational risk in their subscription business. RightRev CFO, Dan Miller, shares his insight

“Leasing is no longer just a financing model—it’s evolving into Everything-as-a-Service (XaaS), where companies must monetize complex combinations of hardware, software, professional services and usage. Our customers told us loud and clear: fragmented systems and spreadsheet workarounds were creating compliance risk, slowing their close, and limiting their ability to innovate.

That’s why we built the industry’s first unified lessor revenue subledger: a single, event-driven engine that connects lease events under ASC 842 directly to revenue recognition under ASC 606.”

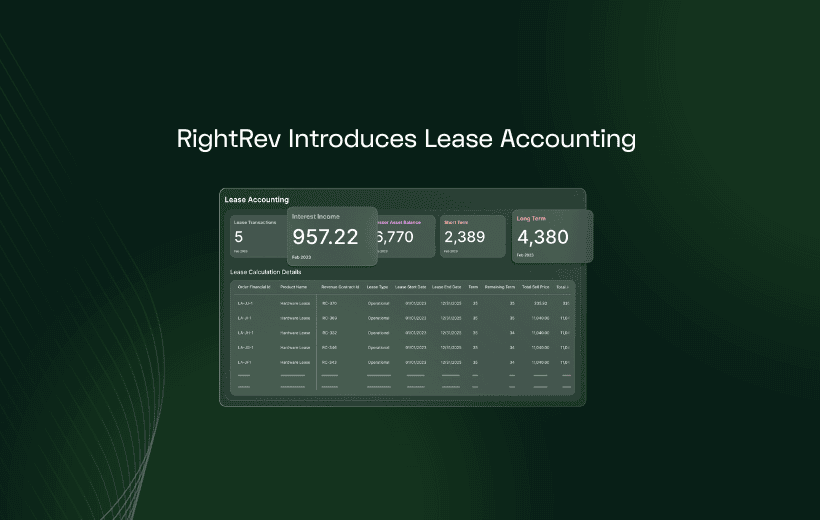

Launching the first integrated ASC 842 lessor module inside the RightRev ASC 606 platform allows finance teams to treat lease accounting as a first-class, lessor-focused capability, not an afterthought.

Ultimately, this architecture gives any company with hardware, devices or equipment the flexibility to launch their XaaS business model to capture recurring revenue and price how their customers want to buy.

How RightRev Closes the XaaS Accounting Compliance Gap

While the product page will go deeper into features, at a CFO level the integrated platform is designed around a few core principles:

1. One contract, modeled once

RightRev ingests the commercial contract from CPQ, billing, or order systems and models:

- Hardware and devices (the lease components)

- Software, cloud, maintenance, services (the non-lease components)

- Terms, options, usage metrics, indices (CPI, rate cards, etc.)

The contract is represented once, then used by both the lease and revenue engines.

2. One SSP allocation engine across ASC 842 and ASC 606

Instead of allocating in spreadsheets, RightRev applies a single SSP-based allocation engine across all components, following the ASC 606 guidance that ASC 842 explicitly references for lessors.

That allocation drives:

- Lease income schedules for the hardware (ASC 842)

- Revenue schedules for software and services (ASC 606)

All without having to rebuild logic in multiple systems.

3. Event-driven Day-2 updates (Contract Modifications)

Contract modifications are where most 842 + 606 errors creep in. In RightRev, every contract modification including extensions, upgrades, CPI/index changes, device adds, and restructures are captured once as an event and drives both sides of the accounting:

- The system remeasures the lease where required.

- It re-allocates remaining consideration using current SSPs.

- It updates both 842 and 606 schedules in lockstep.

This reduces manual touchpoints and preserves an auditable trail of what changed, when, and why.

4. Lessor-focused views, journals, and billing forecasts

Because the platform is built for the lessor:

- You get schedules, rollforwards, and disclosures that reflect lease receivables, net investment, and lease income, together with related recurring revenue.

- Journal entries are generated from a single engine and posted to the GL with clear references back to the originating contract and event.

- Billing forecasts for all payment types: fixed, variable, usage, escalators and index-linked, tied directly to your lease and revenue schedules.

5. Compliance, control, and insight on the same platform

For the CFO and Controller, this architecture is designed to:

- Reduce control risk by removing spreadsheets from the heart of 842/606 interactions.

- Shorten close cycles by automating complex modifications and reconciliations.

- Improve visibility into the economics of your XaaS business, separating financing yield on hardware from recurring software and services growth.

Closing: Don’t Let Lease Accounting Be the Weakest Link in XaaS

Your shift to XaaS, HaaS, or EaaS is the right strategic bet. It drives recurring revenue, closer customer relationships, predictable growth and a story the market understands.

But that same move quietly turned you into a lessor under ASC 842 / IFRS 16, intertwined with ASC 606 / IFRS 15 for every bundled contract. If those standards are still being satisfied by separate systems, spreadsheets, and manual rework, what may be your fastest-growing revenue stream is also your biggest compliance liability.

RightRev’s Lessor Accounting unifies ASC 842 + ASC 606 and IFRS 16 + IFRS 15 in one platform to close the XaaS accounting and compliance gaps, so hardware CFO’s can scale recurring revenue with confidence. Request a demo to see lease accounting for lessors in action.